Irrespective of the benefits, a mortgage consultant is just not automatically right for everyone. Continue reading to find out what a mortgage consultant does, who ought to perform having a mortgage consultant, And exactly how they vary from the mortgage broker.

Questions on the PMI within the mortgage calculator? Figure out why PMI may be demanded for the loan and see tips on how to stay clear of having to pay it.

Job interview the brokers: Ask a good amount of concerns and obtain a come to feel for a way they function and whether or not they are experienced regarding the type of mortgage you’d qualify for.

Remember to Observe - this Web-site might be redirected in the approaching times to icemortgagetechnology.com, in which you should be able to locate facts related to the products and services ICE Mortgage Engineering offers.

The information on the site is not tailor-made assistance to every personal reader, and as a result won't represent money information. Many of the advisors we perform with are entirely skilled to offer mortgage advice and function just for corporations that happen to be authorised and controlled through the Economic Carry out Authority.

Steve, the monetary advisor, contacted me throughout the hour and was really friendly, knowledgeable and professional. He looked as if it would relish my non common prerequisite, diligently held me updated throughout the day and we struck up a terrific romance. Quite impressed.

Less than niche conditions like these, the potential risk of currently being turned down by a mortgage lender or strike with hefty rights are high with no Expert advice; but the best mortgage broker could save you time and expense by introducing you to the appropriate lender, initial time.

Estimate your every month payments, APR, and mortgage fascination level to see if refinancing could be the correct transfer.

Affordability is usually a essential consideration when purchasing a mortgage. Two factors lead to how much you could afford: your deposit and also your credit card debt provider ratios.

To secure a mortgage with Nesto, you will have to borrow no less than $one hundred twenty five,000. If you want a lesser volume, take into consideration a mortgage lender that offers property fairness traces of credit rating (HELOC) instead to a traditional mortgage.

If Nesto turns you down for your mortgage, Equitable Bank could be a excellent next alternative. You’ll pay out a greater here fascination price, however , you’re also much more very likely to be authorized with truthful credit, self-work earnings or other minimal imperfections that make it tough to receive a mortgage.

Nonetheless, you encounter them, Be sure that you’re truly comfy and happy with the consultant you choose ahead of committing.

Mortgage broker, mortgage banker, mortgage consultant -- regardless of what blend you decide on, figuring out they’re educated, have taken time to receive an extra certification by concentrated effort and hard work and really have your passions at heart might make borrowing a mortgage mortgage a good deal fewer terrifying.

Advisor Evaluation: Checks at advisor level, assessing that an individual’s unfold of mortgage lenders and encounter is suitable.

Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Justine Bateman Then & Now!

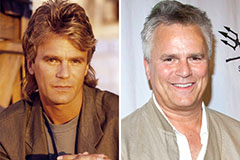

Justine Bateman Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!